With the American economy still uncertain and a huge generation of Baby Boomers either in or nearing retirement, the question for many is, “How do I manage my money wisely?”

“This generation is witnessing the greatest wealth transfer in the history of the world,” said Crowell School of Business professor of finance Dr. Shane Enete. “There’s a lot at stake.”

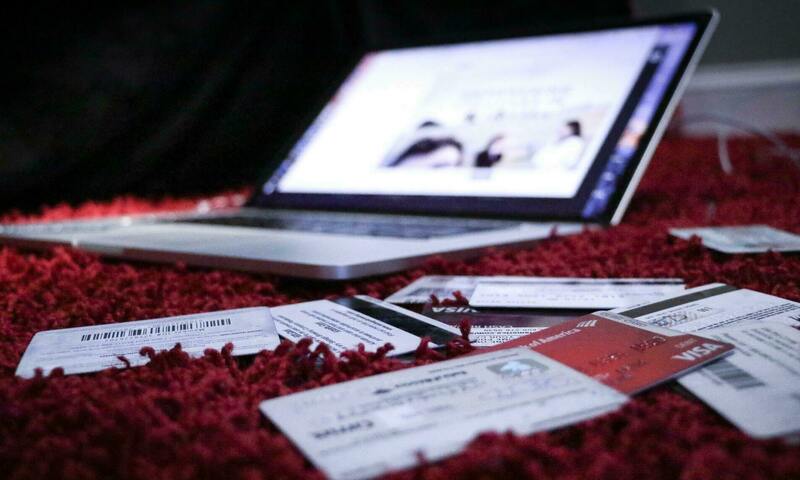

Finances are more complicated than ever. In the primarily-cash economy of the past, it was harder to get deeply into debt. But the availability of credit, along with the ease of online shopping, makes it easy to accumulate debt quickly.

Retirement planning has also changed. Previously, company pensions and social security covered most or all of retirement. Now, people are told that social security will not be enough, and employees are being offered 401(k) retirement plans, but that involves making decisions: How much do I contribute? What should I invest in? And those investment options can be dizzying.

It’s not just a question for retirees, either. Over 44% of millennials say they have too much debt. And according to an American Psychological Association survey, 81% of Gen Z adults are stressed about money; about their spending habits, their debt and their lack of financial literacy.

It’s complicated and it helps to have someone who knows what they’re doing, especially someone who understands how financial planning fits into the bigger plan of the Kingdom of God. For those called to help others manage their money, Crowell is launching a Certificate in Personal Financial Planning in Fall 2021.

“One of the distinctives of the Crowell CFP® program is its deep integration with our biblical and theological foundations,” said Enete. “We take seriously how our relationship with Jesus and the Holy Spirit should guide the process of financial planning — retirement planning, tax planning, insurance, investing, estates, spending and more. This is more than just learning to give investment advice; students will learn the art and science of making a comprehensive personal financial plan, while also exploring the tension between making plans and trusting God.”

There is a growing demand for CFP® certification. Financial managers are ranked #3 on U.S. News’ list of Best Business Jobs, and the Bureau of Labor Statistics is projecting over 100,000 new money-manager jobs between 2019 and 2029. It is not only a solid career path for young professionals, it is also well suited for veterans, those in mid-career change, current financial planners looking to add certification and those looking for a side-career option.

According to a 2019 study of CFP® professionals conducted by Fondulas Research, 93% reported that they were satisfied with financial planning as a career choice, 92% were satisfied with their decision to pursue CFP® certification, and 89% would recommend pursuing certification as a means to advance one’s career. Research by the Aite Group in 2019 found that the average income for a CFP® professional with less than nine years of experience is approximately $145K, but rises to nearly $297K with 15 or more years of experience.

“Becoming a Certified Financial Planner™ means having great personal impact on people’s lives,” said Enete. “It also means a flexible schedule, lots of job prospects and an above-average salary, a rare combination in a profession. This program seeks to train financial professionals in skill and wisdom so that they may be fruitful partners in God’s mission to restore and redeem broken financial households.”

The fully-online masters-level program requires six classes and can be completed in one year. Offered in cooperation with the Certified Financial Planner Board of Standards, the program is designed to prepare students to pass the CFP® exam and become a CFP® professional.

The program can also be seamlessly integrated into the Crowell MBA program — 12 of the 18 units will fulfill MBA electives, requiring only two additional classes to complete the CFP® program. The principles behind Certified Financial Planner™ certification, with its high standards, rigorous education and training requirements, and ethical requirements and commitment to serving clients' best interests, fit well with Crowell’s mission and purpose.

Applications are already being accepted.

Photo by Dylan Gillis on Unsplash

Biola University

Biola University

.jpg)

.jpg)